Misclassification of Employees as Independent Contractors

Misclassification of Employees as Independent Contractors

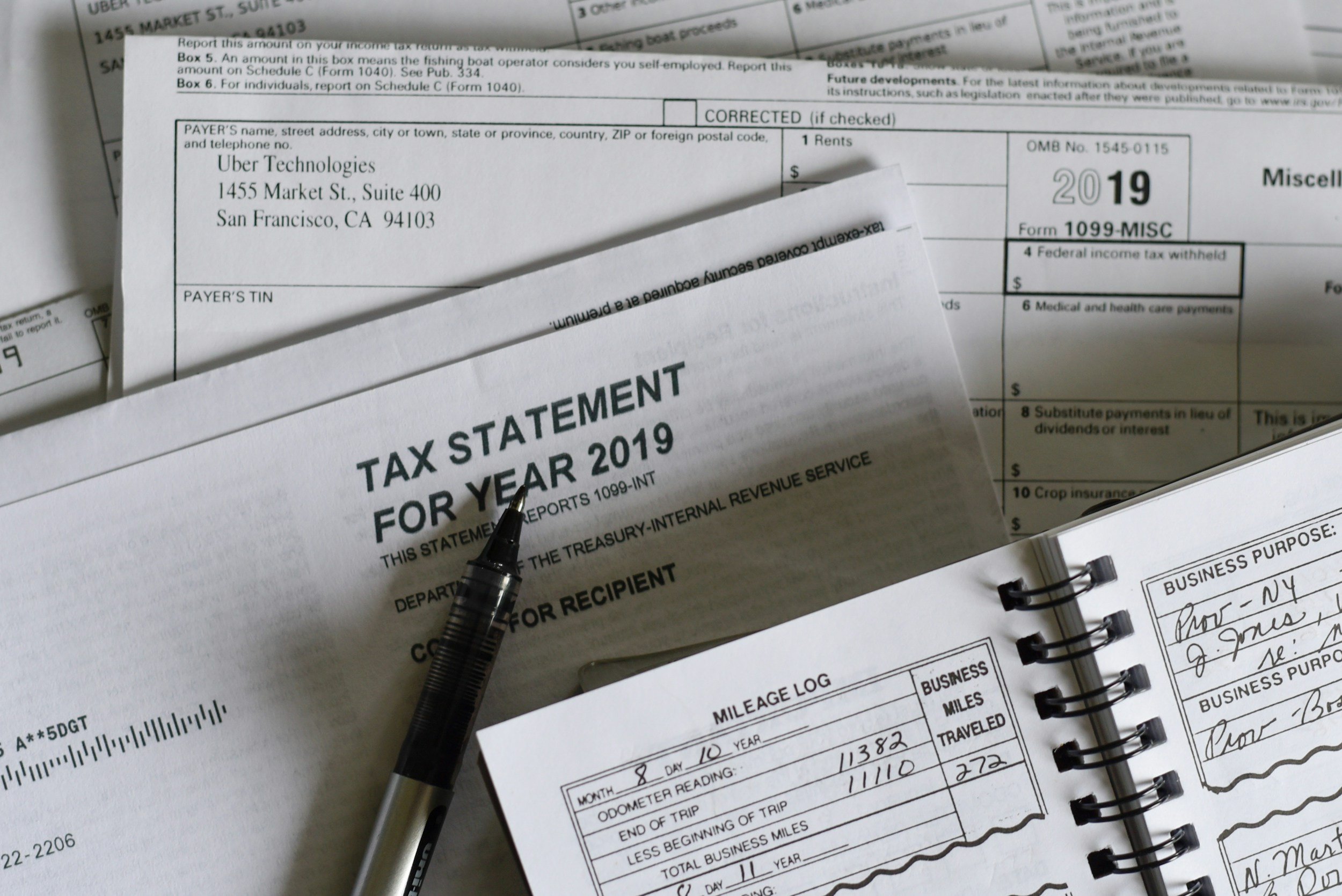

Employers often try to evade legal responsibility by claiming their workers are independent contractors instead of employees. There are a lot of reasons for this. Employers do not need to provide independent contractors with minimum wage, or overtime, or meal or rest periods. They do not have to pay payroll taxes. They do not have to provide workers’ compensation insurance. They do not have to worry about unemployment insurance. It is just a lot cheaper. While it is a lot cheaper for employers, misclassification of employees as independent contractors is criminal.

Employee vs. Independent Contractor

We have gotten many calls over the years from people who say they are “1099 employees”. There is no such thing as a 1099 employee. 1099’s are used for independent contractors. W-2’s are used for employees.

For years there was a lot of confusion over employees and independent contractors. That confusion has gotten worse with the rise of the “gig” economy. The “gig economy” is essentially a means for people to get cheap labor, from people looking (often desperately) to make cash. But, what if “gig economy” workers completely rely on one specific platform? For example, say you were driving for a ride-sharing company. We will call it Guber. You apply to drive for Guber. Guber looks at your credentials. Guber checks your background. Guber even checks your car. Then, Guber says, “Ok. You can drive for us.” You start driving for Guber. Guber keeps sending you these notifications. You must click “I accept” to continue using the app to drive.

Without realizing it Guber made you click “I accept” on this agreement that prohibits you from driving for another ride-sharing company. We will call them Swift. Sure, you can set your own hours for Guber. But, if you are not fast enough to respond to surge pricing, or you do not respond to enough offers of surge pricing, Guber limits the number of rides you get. Before you know it, you are driving full time for Guber. You are doing okay you guess. But, one night you got stuck driving next to the ballpark after a game. Traffic was nuts. Three separate riders complained to Guber. Before you know it, Guber says you cannot drive for them anymore. You are fired. So, are you Guber’s employee or independent contractor?

If you want to understand the difference between an independent contractor, and an employee, think about plumbers. If your home needs a plumber, you call the plumbing company. The company tells you approximately when the plumber is coming. The plumbing company sends the plumber. That plumber might get there when the company said they would get there, or they might get there six hours later. That plumber comes into your house, asks where the leak/clog is, and gets right to work using his/her tools. Then, the plumber gives you a bill for the services. That plumber is an independent contractor of yours. They control when they work, how they work, what they work with, and what they will charge for their service. Now, that plumber is likely an employee of the plumbing company. But it would be weird to say that plumber was your employee, right?

California Laws on Employees vs. Independent Contractors

The California Courts and legislature had grappled with employees vs. independent contractors for a while. But, in April 2018, the California Supreme Court, in Dynamix Operations West, Inc. v. Superior Court (2018) 4 Cal.5th 903, changed everything. In Dynamex, the plaintiff, and putative class members were delivery drivers for Dynamex. Dynamex originally classified the drivers as employees. But then reclassified them as independent contractors. The drivers did the exact same job. But, did not have any of the same benefits. The drivers claimed their rights were violated. The California Supreme Court was sympathetic.

The California Supreme Court addressed the specific factors to consider when determining if a worker is an employee, or an independent contractor. The Court said:

The “suffer or permit to work” definition of employ may be relied on in determining whether a worker is an employee, or an independent contractor;

Misclassification cases begin with the presumption that workers are employees; and

Employers bare the burden of proving workers are independent contractors, and not employees using the “ABC test”.

Under the ABC test, a worker will have been “suffered or permitted to work,” and thus, an employee, and not an independent contractor, unless the employer proves each of the following:

that the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

that the worker performs work that is outside the usual course of the hiring entity’s business; and

that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

It is on the employer. Not the employee.

Support for gig economy workers prompted the legislature to pass AB5 to codify the ABC test and the Dynamex decision, adding §2750.3 to the Labor Code. In doing so, the state legislature provided workers greater protections like:

minimum wage;

overtime;

meal and rest periods;

sick leave;

workers’ compensation insurance;

unemployment insurance; and

many, many more.

You could see how much of a difference it makes being an employee vs. an independent contractor during the COVID-19 coronavirus pandemic. Employees who got let go from work got unemployment insurance. Employees who got sick with COVID-19 got paid sick leave, and workers’ compensation. Independent contractors got…the ability to set their own hours? But, then again, lots of employees can set their own hours too. Not surprisingly, gig economy employers were upset at the passing of AB5. Lyft, Uber, and DoorDash, pledged to spend $30 million each on a 2020 ballot initiative to reverse AB5. Somewhat surprisingly, they won as the fear of increased pricing won out over workers’ rights.

The fight isn’t over. We are still here. We are still fighting for workers’ rights.